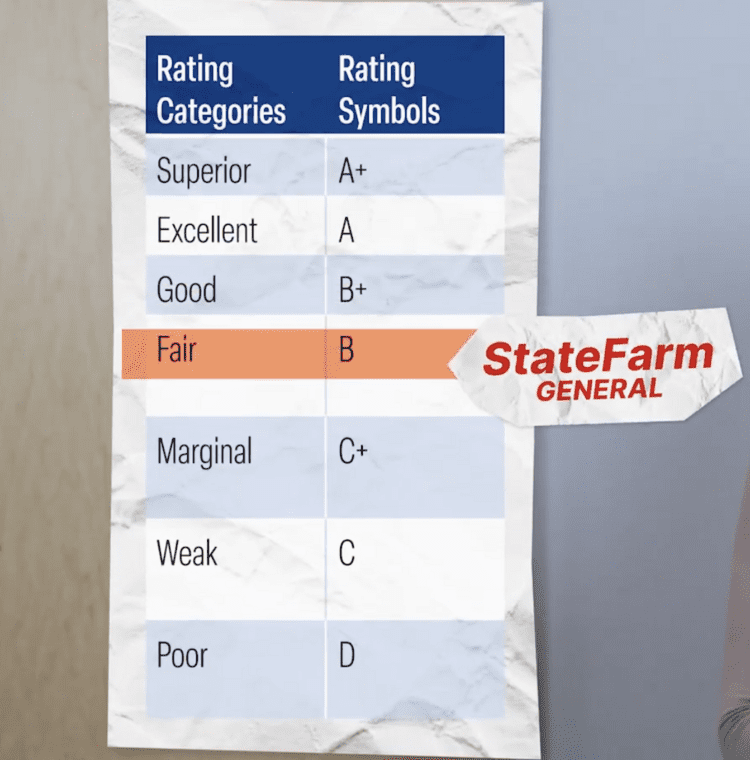

The financial strength rating of State Farm General Insurance Company was recently downgraded from stable to negative, moving from A (excellent) to B (fair), while the insurer’s long-term issuer credit rating (ICR) fell from “a” (excellent) to “bb+” and now also carries a negative outlook.

Bottom line, State Farm General's balance sheet strength, marginal operating performance, neutral business profile and enterprise risk management were all assessed as weak.

As an independent agent, we don't offer insurance from State Farm. And we're proud to say that the companies we represent all have A ratings which means they have strong financial stability and the ability to fulfill obligations, especially when it comes to paying out claims.

The news about State Farm' General's B rating is scary for all their customers and the insurance industry in general.

State Farm General recently announced nonrenewals for 72,000 California policies across commercial and personal property lines. And all State Farm customers can probably expect some dramatic increases in their premiums, as well as being more at risk for potential claims being held up as State Farm General seeks to regain its A rating.

State Farm General, which serves California, has been hit hard by all of the weather-related claims throughout the state. But natural disasters are not unique to just California. There were 28 weather and climate disasters in 2023, surpassing the previous record of 22 in 2020, tallying a price tag of at least $92.9 billion, not even counting the costs of the December 16-18 East Coast storm and flooding event that impacted states from Florida to Maine.

According to the National Association of Insurance Commissioners' 2023 market share report, State Farm Group is the largest homeowners carrier in the U.S. with nearly an 18% market share. If one of the largest insurance companies in the U.S. is in trouble, that serves as a wakeup call to the entire insurance industry.

As an independent insurance agency, we always do our best to find the ideal policy that's right for you and your needs. We can't guarantee your rates won't go up. But we do promise to continue to align ourselves with companies that are adept at maintaining their insurer financial strength rating.